Our Offerings

We provide solutions for Institutional investors. financial and non-financial companies, governments and multilateral international organizations.

GlobalAI Co.

"It's time to harness the work and intellectual creativity of those outside the official statistics tent"

Steve McFeely

Chief Statistician of the UNCTAD Statistics Division

A Platform to Align Private Sector Sustainability Reporting with the SDGs

Using the most advanced artificial intelligence technologies, machine learning and Natural Language Processing (NLP), our innovative technology enables us to uncover hidden sustainability and non-financial risks.

What Our Platform Enables

Important Insights for Institutional Investors

Our short-term and long-term ESG/SDG indicators provide important insights for institutional investors. In addition, we offer Sentiment, Stress/Risk indicators, leading volatility signals, Equity Factors, and custom Big Data and AI solutions for institutional investors, including:

- ESG & SDG Scores, Benchmarks, Indices, Signals and Ratings. This includes short-term, long-term, volume, dispersion and momentum signals.

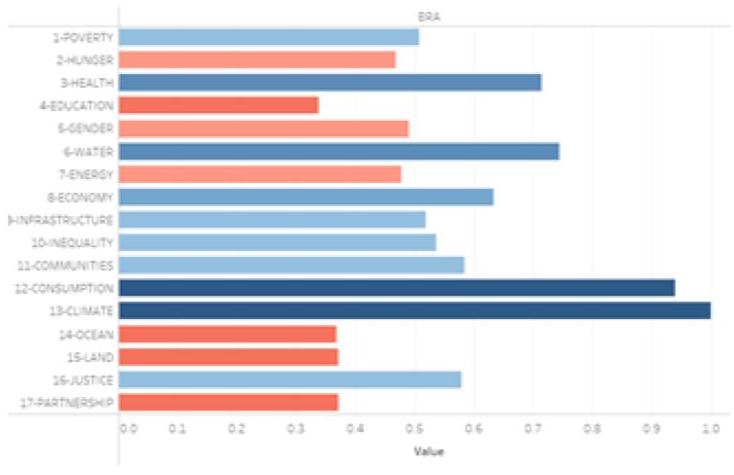

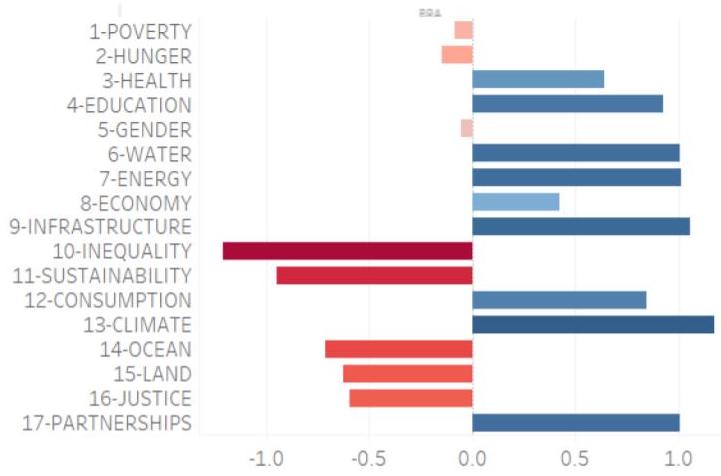

- SDG Scores for each of the 17 SDGs as well as a company total SDG score

- Enable ESG/SDG-tilted strategies and thematic investments

- Optimize risk-return-impact decisions across equity and bonds

- Equity and Bond ESG/SDG screening & attribution

- Compare your ESG/SDG exposure and risks across portfolios and benchmark against ESG/SDG Indices

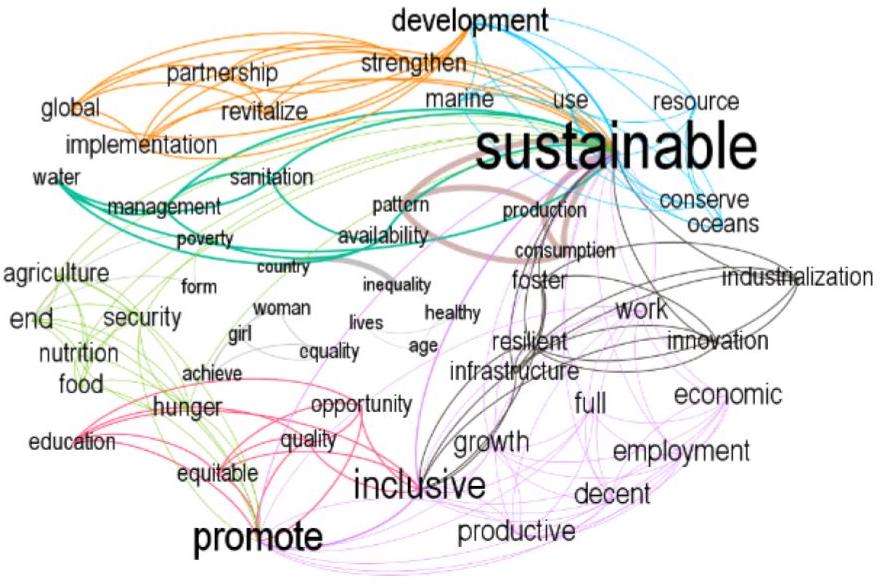

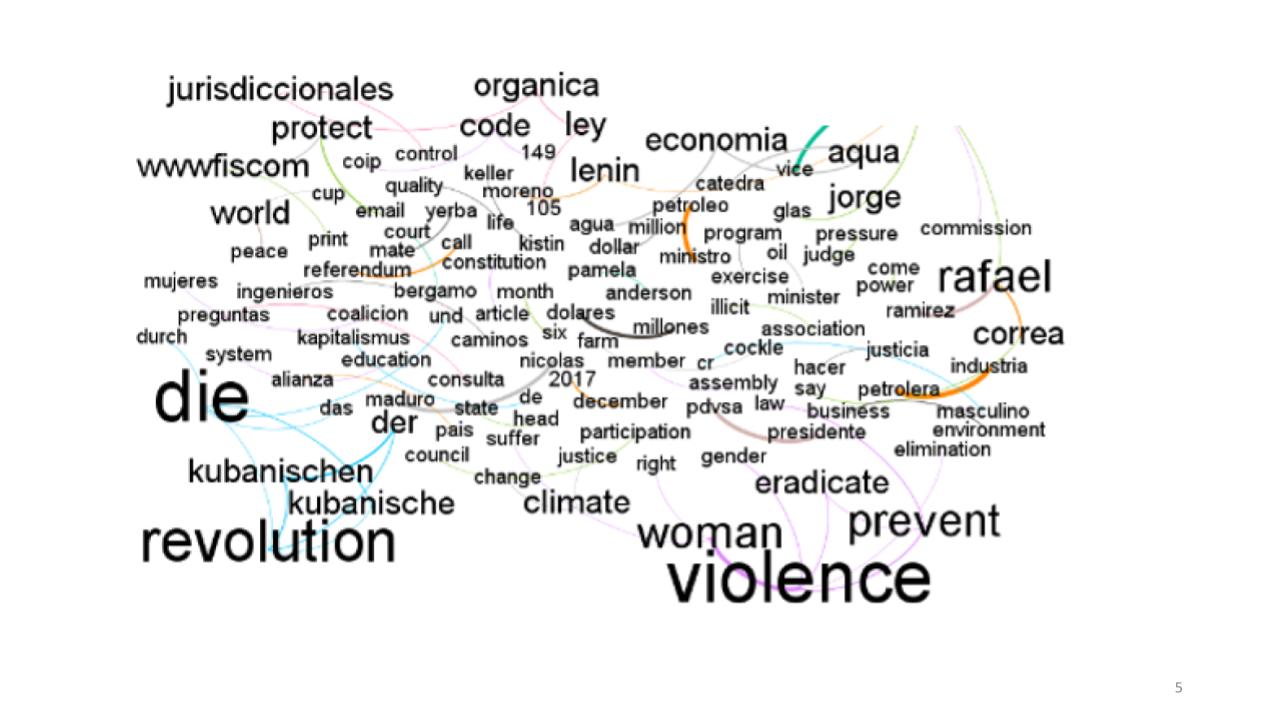

- Advanced text analytics & insights, including word clouds

Macro-Financial Indicators

- Equity Cross-sectional Anomalies

- Earning Surprises

- Macroeconomic Surprises

- Leading Volatility Indicator – VPIN

- GDP Now-casting & Forecasting

- Turbulence Scores

- Absorption Ratio Scores

- Market Regime Scores

- Variance Risk Premium

- Composite Indicator of Systemic Stress

Sentiment & Event-Driven Indicators

- News Sentiment Scores

- Country SDG Risk Scores

- Country WEF-Based Risk Scores

- WEF Risk Factors

- Sensitivity Analysis

- Global Economic Dashboard

Our advisory work

Our short-term and long-term ESG/SDG indicators provide important insights for institutional investors. In addition, we offer Sentiment, Stress/Risk indicators, leading volatility signals, Equity Factors, custom Big Data and AI solutions for institutional investors.

- ESG & SDG Scores, Benchmarks, Indices, Signals and Ratings. This includes short-term, long-term, volume, dispersion and momentum signals.

- SDG Scores for each of the 17 SDGs as well as a company total SDG score

- Enable ESG/SDG-tilted strategies and Thematic investments

- Optimize risk-return-impact decisions across Equity and Bonds

- Equity and Bond ESG/SDG Screening & Attribution

- Compare your ESG/SDG exposure and risks across portfolios and benchmark against ESG/SDG Indices

- Advanced Text Analytics & Insights, including Word Clouds

Click on an image to expand it.

Supporting clients in socially impactful projects

Our text mining algorithms (NLP) are used to analyze the content of a Country’s National Development Plans and VNRs, and quantify their alignment to the SDGs.

This can serve as a roadmap for investors seeking to quantify how supportive or unsupportive a country’s policies are in relation to each of the SDGs. For example, if an investment fund or corporation is looking to invest in a renewable energy plant in a particular region, it can evaluate if a country has a high positive or negative score in SDG 7 (Affordable and Clean Energy). If the score is positive, this would improve the risk-return profile of the investment in that particular country.

Likewise, a government can use this information to make it more attractive for portfolio and FDI investors across strategic sectors. Below: The Global Algorithmic Institute at Global AI provided the first global analysis of the SDG ‘footprint’ of the private sector at the regional and global level, for policy purposes, covering approximately 20,000 companies in more than 100 countries. Our data were included in a flagship report from the UN Inter-Agency Task Force on Financing for Development in April 2020.

(Click on image to expand)

Infrastructure Match-Making

The Global Algorithmic Institute at GlobalAI has implemented an SDG Infrastructure Projects-Investors Matchmaking Platform designed to systematically match infrastructure projects with institutional investors. The system uses machine learning with a data-driven approach to promote the mobilization of private investment for the SDGs. It is designed to to help close the multi-trillion dollar financing gap required to reach the SDGs.

This platform can add value to the GISD and supplement the SDG Investment Fair by contributing to increase the number of potential Project-Investor matches through the following features:

Showcase Investment Projects 24x7x365

The platform provides a central online location for countries to showcase their investment projects to global investors all year round, including before, during and after the SDG Investment Fair.

Deliver Project Specs in the Format Required by Investors

Projects will be showcased with information in the format required by investors, including both financial and sustainability information using SDG metrics.

Increase Access to Project Specifications

Platform will be made available to investors attending the SDG investment fair and those from networks representing trillions of dollars in Assets under Management, including the UN PRI and others.

Country-Investor Collaboration

Countries can collaborate online with investors to resolve regulatory and policy obstacles that are hindering private investments.

Identify Where Policy Changes Are Needed

The system will provide analytics derived from investor’s survey data, making it possible to determine that a given policy or regulation in a certain country is blocking X billions in potential private investments towards infrastructure and other SDG projects.

Project-Investor Match-Making

Based on information provided about investment projects and the investor’s profiles, the system will match both investors and projects systematically.

Information Support for Investors

The system will enable investors to search for investment projects based on their characteristics. Supplementary analytics and alternative data will help investors make more informed risk/return impact decisions and incentivize private sector capital flows.

Track SDG Investment Impact

System will use surveys to track SDG impact metrics over time after projects and investors have been matched and deals have been completed.